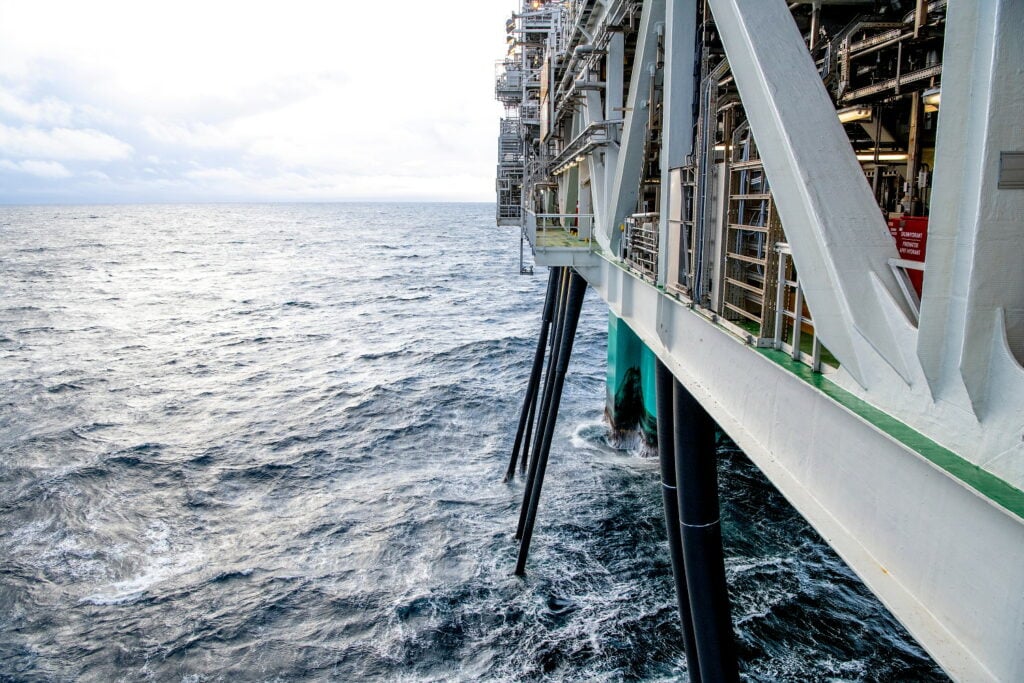

Vår Energi works continuously to extend the production of oil and gas on the Norwegian continental shelf.

Our flexible and resilient portfolio extends over the entire Norwegian continental shelf, and has significant production and exploration potential.

Vår Energi’s hub strategy is designed to ensure long-term growth and value creation.

As part of Vår Energi’s hub strategy, the company identifies strategic focus areas that provide a framework for evaluating exploration and development opportunities, maximising the use of resources and optimising value creation throughout Vår Energi’s portfolio.

Vår Energi is the operator of the following producing fields: Goliat (Barents Sea), Fenja (Norwegian Sea), Gjøa, Duva, Balder and Ringhorne (North Sea).